CEF Vs UTF Features

Closed-End Funds

Unique Features of Closed-End Funds

Premiums/Discounts

Like the share price of any listed company, the share price of a closed-end fund (CEF) need not equal its net asset value (NAV). Again like the share price of any listed company, a CEF may trade at a premium or discount to its NAV. This premium or discount feature of any listed company is a feature that cannot be found in unit trust funds (UTF). For CEFs, it is also a feature that provides investors with the potential for additional returns. When the CEF’s premium widens or its discount narrows, the return of the CEF, based on its share price, will be greater than the NAV return. i Capital considers 3 simple examples.

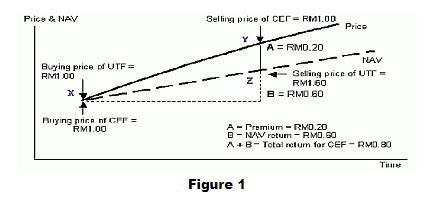

[1]. The first example is shown by Figure 1. It shows the return to an investor in a situation where the CEF is issued at par during the IPO stage and subsequently moves to a consistent premium. This can happen when the fund manager has a consistently superior track record and investors are confident that the NAV of the CEF will expand. It shows how CEF investors can exploit a premium widening.

A UTF investor would buy and sell based on NAV. In figure 1, a UTF investor buys at point X or RM1.00 and sells at point Z or RM1.60, giving him a return of RM0.60 (before subtracting loading charges). In figure 1, a CEF investor buys at the same point as the UTF investor, ie point X or RM1.00. Over time, the CEF moves into a premium. The CEF investor sells at the same time as the UTF investor, which corresponds to point Y or RM1.60. This gives the CEF investor a total return of RM0.80 (A+B), which consists of an NAV return of RM0.60 (B) and a premium of RM0.20 (A).

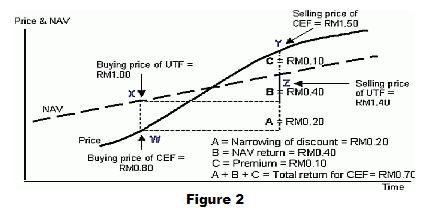

[2]. Figure 2 shows the second example where a CEF moves from a discount to a premium, a situation that happens rather frequently. Assume that an investor buys a CEF at point W or at RM0.80, when the CEF is trading at a 20% discount to NAV. Over time, the discount evaporates and turns into a premium of 10%. The CEF investor decides to sell the CEF at point Y or at a price of RM1.50.

The CEF investor’s total returns are made up of 3 parts : . The narrowing of the discount – Part (A) = RM0.20, [ii]. The return on NAV, Part (B) = RM0.40, and [iii] The RM0.10 premium, Part (C). Had the investor invested in a UTF at the same time as he bought the CEF, he would have bought at point X or at RM1.00. If he sells his UTF at the same time as he sold the CEF, he would have done so at point Z or RM1.40. His gross returns from the UTF would only be RM0.40 (before subtracting any loading) or Part B. Obviously, this is much less than the returns of the CEF investor.

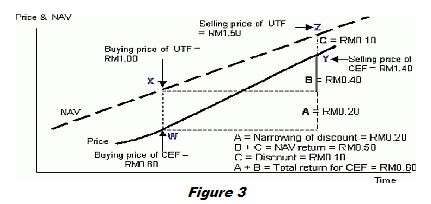

[3]. The third simple example is captured by Figure 3. It illustrates the return to an investor in a situation where the discount of a CEF narrows but does not move into a premium. Again, assume that an investor buys a CEF at point W or RM0.80, when the CEF is trading at a 20% discount to NAV. Over time, the discount narrows but does not disappear. At point Y or RM1.40, the investor decides to sell the CEF, which is then trading at a smaller discount of 6.7%.

The total return to the CEF investor is Parts B + (A ? C). Part B + Part C represent the NAV return of RM0.50 (RM0.40 + RM0.10). Part A represents the initial discount of RM0.20. However, as the CEF is still trading at a RM0.10 discount at point Y, Part C is deducted from Part A (RM0.20-RM0.10). So the total return to the CEF investor is Part A + Part B or RM0.20 + RM0.40 = RM0.60.

Had the investor invested in a UTF instead, buying at point X and selling at point Z, he would have made a gross return of Parts B+C, which is the NAV return of RM0.50 (before subtracting loading).

It is important to note that in a situation where the discount is narrowing, Part C can never be greater than Part A. From this, we can deduce a very important point. Parts A+B will always be greater than Parts B+C. So, when the discount narrows or when the premium widens, the returns from investing in a CEF will always be greater than the returns from investing in a unit trust.

In Malaysia, the front-end or back-end loadings can range from 2% to 7% of NAV. The load is added to the NAV of the shares when calculating the offer price. Consequently, the net returns to a UTF investor would be Part B less the front-end and/or back-end load.

Like the share price of any listed company, a CEF may trade at a premium or discount to its net asset value (NAV). This premium or discount feature of any listed company is a feature that cannot be found in unit trust funds (UTF). For CEFs, it is also a feature that provides investors with the potential for additional returns. When the CEF?s premium widens or its discount narrows, the return of the CEF, based on its share price, will be greater than the NAV return.

Popular misconceptions of CEF – fact or fiction?

A common fallacy that plagues analysts and public perception is that CEFs trade at discounts and are not an attractive investment option. Is such a view valid? Is the discount so unique after all?

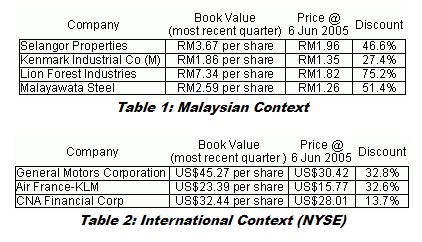

An observation of the share price and book value (or NAV) per share of the other listed companies shows that a mismatch between price and NAV is a very common phenomenon. Tables 1 and 2 clearly illustrate this in both the Malaysian and international context. In fact, to question it as an anomaly would be akin to saying that all prices quoted on stock exchanges are equal to the intrinsic values of the said companies. There is really no justification to expect the share price of a CEF to equal its NAV.

The above examples are far from exhaustive. In the case of CEFs or UTFs, the asset or share prices are updated every day. Thus, the NAV of CEFs or UTFs are updated very frequently. In contrast, for the other listed companies, their asset values are not revalued on such a frequent basis. In fact, assets or properties of many listed companies have not been revalued for decades. For example, if one were to value all the properties of Telekom or TNB or Genting or Sime Darby or Golden Hope at the current prices, one might get massive discounts from their true asset values. Then, there are those companies where the real assets are their valuable brands or precious licences. Would Hotel Shangri-La or Guinness or BAT be so profitable if they do not own the brands or if Magnum or Tanjong does not have the lucrative gaming licences? Incorporating such valuable assets would increase the discounts to NAV even more. So, share prices trading at discounts to NAVs are not a unique feature of CEFs. As a matter of fact, shareholders of a Malaysian CEF should take great comfort in the fact that there is no dictatorial 51% controlling shareholder who is most happy to let the status quo remain unchanged even when minority shareholders are unhappy.

There are many spurious arguments that have been put forth by academics and researches to explain why CEFs trade at discounts/premiums to NAV. Among them are agency costs and investor sentiment. According to the agency cost argument, the behaviour of the premium/discount is driven by the trade-off between managerial ability and fees and expenses. Managerial ability adds value to the CEF, while fees and expenses subtracts value from the CEF. The discount reflects management fees and other expenses incurred by the CEF in excess of the value of services rendered. Or vice-versa. What is most perplexing is that this agency cost argument is equally applicable to any listed or even unlisted company. For any company or business, managerial ability will determine what value is being added, while fees and expenses will subtract value from the company or business. CEF premiums/discounts are also a measure of investor sentiment. Discounts are high when investors are pessimistic about future returns and premiums appear when investors are optimistic. Again, this argument is equally applicable to any listed company. Hmm,we wonder whether the researchers were really doing their research.

Avenues to exploit a discount

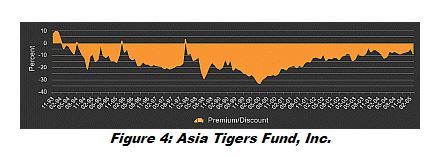

Nevertheless, there are various avenues that a CEF investor can take to narrow or even eliminate a discount. The fact that a CEF in Malaysia has no 51% controlling shareholder translates into greater power for shareholders to pressure the CEF to deliver better performance. In Malaysia, a single shareholder can hold a maximum of 20% of the paid up capital of a CEF. Such shareholder activism is clearly illustrated in the case of Asia Tigers Fund, Inc (ATF), a CEF listed on the NYSE.

In Jan 2000, Harvard University (Harvard) bought 2.28 mln shares or 11% capital in ATF, which was then trading at a 25% discount. By Dec 2002, Harvard held almost 23% capital in ATF. Harvard and other shareholders then pressured ATF to convert to an interval fund, whereby ATF will offer to repurchase its own shares periodically to narrow the discount. By Nov 2003, the discount narrowed to 7% and Harvard sold its stake.

Between Jan 2000 and Nov 2003, ATF’s share price appreciated 45%, whereas the NAV return was only 27%. Had ATF been a unit trust fund, Harvard?s gross return would be much lower at 27%, as it would not have been able to take advantage of the narrowing of the discount.

Other mechanisms that a CEF can adopt to narrow or eliminate discounts are:

[1]. Open-ending

This is where a CEF converts to an open-end structure. Once a CEF open-ends, investors can sell their shares back to the fund manager, who redeems them at NAV. Although open ending is an option available in foreign markets, the current guidelines and regulations in Malaysia need to be carefully researched, as it has not been conducted before.

[2]. Liquidation

This is where a CEF is simply wound up. As the CEF approaches the liquidation date, the discount narrows. At the close of business, the discount disappears. All assets are liquidated and shareholders are returned an amount equal to the NAV per share.

[3]. Share repurchase

This is where a CEF buys back its own shares. Share repurchases give investors the impression that fund managers are trying to reduce the discount, which helps to boost demand.

[4]. Managed distribution policy

This is where a CEF introduces or increases the frequency of dividend p ayments to shareholders to stimulate interest in the CEF.

[5]. Takeover

Additionally, a CEF that trades at a discount may be a target for a hostile or friendly takeover as it represents an opportunity to buy assets on the cheap. CEF shareholders that are unhappy with the fund’s performance may also call a special meeting to change the board of directors or fund manager or even the CEF’s investment policy. In Malaysia, it is theoretically simple for shareholders to exert influence over the direction and affairs of a CEF or attempt a takeover, as there is no 51% controlling shareholder. The process is relatively easier for CEF shareholders than unit trust holders. With UTFs, the unit holders have no choice but to go through the Trustees.

CEFs trading at premiums

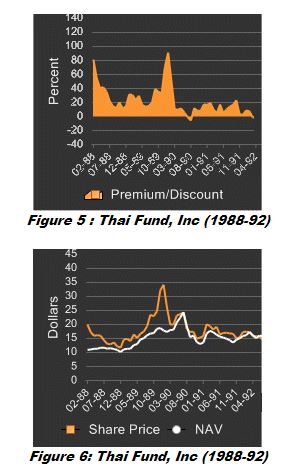

What about CEFs that trade at consistent premiums? Figure 5 shows the Thai Fund, Inc, a CEF listed on the NYSE, trading at a premium for the first 4 years after its listing. If an investor had not bought at the initial public offering stage, he would have missed the boat. Looking at Figure 6, which gives the Thai Fund’s NAV and share price history since inception, during that same period, investors would have gained not just from the persistence of premium, but also from the appreciation in NAV.

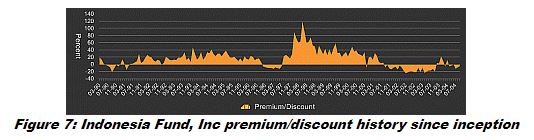

Figure 7 shows the Indonesia Fund, Inc, also listed on the NYSE. The Indonesia Fund traded at a premium upon listing, went into a discount for a short spell after that, and then traded at persistent premiums for the next 4-5 years.

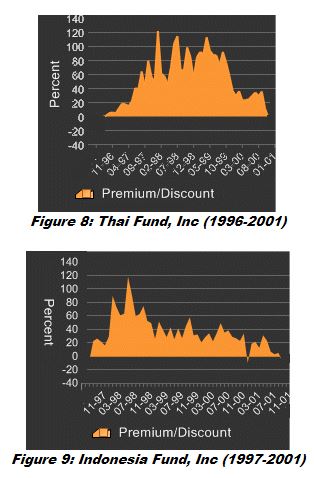

CEFs at premiums during bear markets

A less known feature of CEFs is the hefty premiums they fetch during bear markets. Figures 8 and 9 show the experience of the Thai and Indonesia Funds again. During the Great Asian Crisis, these 2 funds traded with premiums as high as 120%. Had both Thai Fund and Indonesia Fund been unit trust funds, investors would have been decimated.

The rationale for these premiums are : [1]. The investors in CEFs are typically more sophisticated and more experienced than those found in UTFs, which are typically sold to retail investors. They know that the bear markets do not last forever and there is no reason to sell blindly during a panic, like during the 1997/98 Great Asian Crisis. On the supply side, there are no panic sellers. [2]. At the same time, on the demand side, investors are willing to pay more for a dollar of asset knowing that the next cycle after a bear market will be a recovery. In anticipation of the recovery in share prices, investors are willing to bid up the prices of CEFs to premium levels.

Why does a CEF trade at a consistent premium?

Essentially, although there are similarities, one must not confuse a CEF with a UTF, as there are major differences between them. One of the most important differences between the two collective investment vehicles is who is the REAL fund manager. In the case of a UTF, we have already explained that the REAL fund manager is the thousands of unit holders. In the case of a CEF, because it does not have to deal with inflows and outflows of funds, the decisions of its appointed fund manager are totally independent from the shareholders. So, if you have a lousy fund manager, just like if you have a lousy CEO, then, the CEF or the company will not perform. But if the CEF has a top performing fund manager or CEO, then, the company will fly and will trade at a persistent premium.

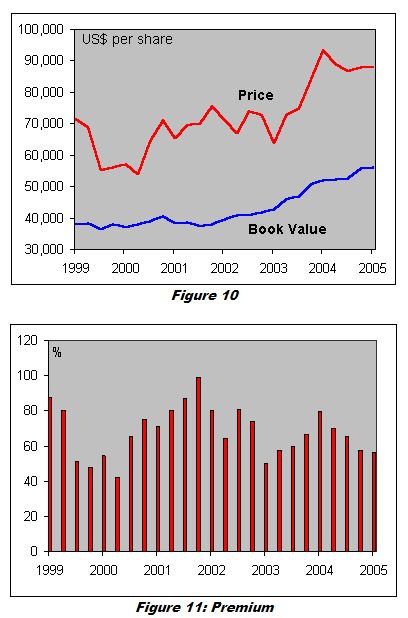

Subscribers should know the superior track record of Warren Buffett and the performance of Berkshire Hathaway. Although it is a not a conventional CEF, Berkshire Hathaway has many features that parallel those of a conventional CEF. Figures 10 and 11 show the persistent hefty premium history of Berkshire Hathaway. Will icapital.biz Bhd have a similar experience?

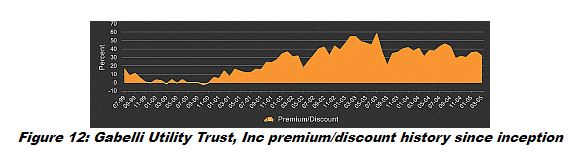

Figure 12 shows the premium history of Gabelli Utility Trust, Inc, a CEF managed by Mario Gabelli, a well-known US value investor. Again it is trading at a persistent premium. The message is simple. When a CEF is managed by a fund manager with a good track record and a sound investment philosophy, the CEF will sell at a persistent premium.

Unit Trust Funds

Unique Features of Unit Trust Funds

There are certain features that are unique to a unit trust fund (UTF). Listed below are some of these unique characteristics.

[a] Redemption and funds inflow

Guaranteed buy back feature

Redemption is a, if not, the most prominent feature of a UTF. Investors are comforted by the fact that if they are not satisfied with the fund’s performance or if they need the money in a short period of time, the unit trust management company (UTMC) has to meet their redemption requests, whatever the amount maybe. The guaranteed buy back at NAV with or without loading (be it forward pricing or historic pricing) by the UTMC makes the amount of funds available for investing by a UTF very volatile. The stock market is driven by cycles of fear and greed. When the market is bullish, investors tend to be greedy and pour new funds into unit trusts. When this happens, the UTMC will be flushed with cash and they find it hard to justify leaving the funds idle, so the fund manager has no choice but to buy shares at valuations that are not attractive anymore. Vice versa, when the market is bearish, investors will be fearful and panic and start redeeming their units, therefore forcing the fund managers to pay the unit holders. If the UTMC does not have enough spare cash to meet the redemption requests or has to maintain their asset allocations, then they will be forced to sell their shares in a falling market. But it is precisely during this period that valuations are attractive and the fund manager would have missed a buying opportunity. One wonders when the fund manager of a UTF has the chance to buy low, sell high. With the constant inflows and outflows of funds, it is hard to imagine that the investment decisions of a UTF are based on the expertise and skills of the fund manager.

[ii] Unable to fully utilise funds raised

Due to the guarantee buy back feature, the UTMC has to keep a certain level of free cash in anticipation of redemption requests without having to sell their investments at unfavourable prices. It has to anticipate the redemption needs of thousands of unit holders during a panic market. It would be very difficult for a UTMC to convince thousands of unit holders not to redeem their units in a falling market. When the UTMC is forced to sell in a falling market, not only is the net asset value (NAV) affected but it is also a self-fulfilling prophecy. Whereas in the case of a fund with a stable pool of money, it does not have to worry about redemptions and is able to invest all the money available.

[iii] Investment opportunities

Due to the guarantee buy back feature (and the inflow of new funds) which causes the size of a UTF to fluctuate, the UTMC has less flexibility to invest in illiquid equities or small capital stocks and do not have a chance to implement a long-term strategy, which provide better returns. On top of that, because the UTF fund manager has to adopt a more short-term investment strategy due to the constant inflows and outflows of funds, the problem of frequent reinvestment occurs. Finally, by buying and selling more often, a fund manager is incurring more expenses for the UTF, which eats into the performance or returns.

[iv] An expensive escape route?

Many unit trust investors see the redemption feature as a quick escape route when they fear a falling stock market. This is unfortunate as in the first place, most UTF are meant for the long-term. If an investor is investing for the long-term, he would not be concerned about having to pull out from the investment within a short period of time. The second point is that most investors have the wrong focus. They would focus on the past performance of the fund. Like what was mentioned in the prelude on collective investment schemes, the crucial factor that will determine the future performance of the fund is the fund manager. All the risk management features incorporated in a UTF would not be of much use if you have selected an UTF that is not well managed, because by the time you redeem your units, the damage would have been done. So if you have chosen the right fund manager, then the redemption feature would just be a method of realizing some profit from your investments instead of a tool for panic selling.

So redemption and inflow of new funds in a UTF can be a double-edged sword for investors if they are not careful.

Net Asset Value (NAV)

As the article on performance explained (see i Capital dated 26 May 2005), the NAV is a very important indicator of how good or how bad the UTMC has managed the UTF, unlike a listed company where the performance of the management can be measured using other methods like earnings or sales growth, etc. The NAV is an accurate measure of the value of the investments in the unit trust, because it is marked to market and updated daily; whereas a listed company does not value its assets on a daily basis. However, a unit holder can make a gain only when the NAV of the unit trust increases and/or receive distributions from the UTF. In contrast, the write up on Closed?end funds gave a very clear picture on how an investor can benefit from a discount or premium to NAV.

[c] Marketing

. Methods of increasing managed fund size

A UTMC can increase their fund size through 3 methods. One, have more unit trust funds under its management; two, increase the units sold and three, investment gains. Whenever something new is introduced in the market, it is easier to attract people’s attention and curiosity. Out of the three methods, the easiest way to increase the fund size and management fee is to launch new funds. This is because a lot of interest can be generated from marketing efforts and the UTMC would not have to worry about marketing an existing average performing fund.

No one ever market mistakes or failures. It is the same with UTF. You only see the best performers and all their awards and certifications in the websites or brochures or newspapers. Most agents will just highlight the best performing fund or a new fund to potential unit holders. So those funds that have not performed well will eventually be cold freeze. What this means is that it would be very difficult for the NAV of the non-performing UTF to increase because there would be little inflow of new funds from potential or existing unit holders to invest while having to face redemption requests.

[ii]. Marketing agents and sales force

Another feature of unit trust would be the sales force, either engaged on a part-time or full time basis to market their UTF. The approach that the UTMC has adopted is more like what is done by banks to promote their credit cards, mortgages and loans or insurance agents who are selling insurance policies or even direct selling companies where agents and distributors approach you personally and try to persuade you that it is the best product to invest in. As was mentioned in the previous article on marketing channels, agents’ commission are structured on a tier basis, like what is practiced by companies that have agents and distributors to do direct marketing to clients or potential clients. When recruiting agents, the sales pitch is always how you can earn millions and enjoy expensive overseas trip for free if you sell a certain amount and it is achievable. To qualify as a unit trust agent, the minimum qualification is just a SPM certificate and pass an exam that consists of 60 to 80 objective questions on the unit trust industry. The UTMC will conduct a full day course before the examination is held based on the guidelines issued by the Federation of Malaysian Unit Trust Managers (FMUTM). Exams are held every 2 weeks and the registration fees for the course and examination is around RM250. Sometimes to attract young people, the UTMC will give a rebate on the registration and examination fees if the new recruit reach a certain sales target.

[iii] Who bears the marketing cost?

Of course having agents to sell aggressively and collect a bigger pool of money would bring about economies of scale and more management fees. As was explained in the previous articles on marketing channels and fees and expenses involved in a unit trust (see i Capital dated 12 May 2005), the commission that a unit trust agent gets is all borne by the unit trust holders. Why should the existing unit holders be the one paying for the marketing expenses to attract new unit holders? The existing unit holders have no control over how much marketing is done and at what cost.

[d] Automatic investing

Automatic investing allows investors to transfer a fixed amount of money from their savings accounts every month. It can be as little as RM100. When a unit holder decides to invest regularly, he is actually averaging the buying price, which is also known as dollar cost averaging. It is a simple and disciplined method of investing. When investing in the stock market, very often investors get caught up in the excitement of a bull market and invest at the peak. Then when the market dives, they have to hold the counters for a long time and if they are lucky, only to sell at the price that they bought. Dollar cost average method helps prevent this kind of mistake, because a unit trust investor does not have to time the market when making a purchase. A fixed sum of money is going to be invested in the unit trust regardless of whether the market is going up or down, a unit holder does not have to worry that a large chunk of investment is made at the peak of the market. When the counters are more expensive, then the same amount invested every month will be able to create fewer units; if the counters are cheaper, then the same amount of money can create more units. The cost of buying will average out. However, the unit holder will also have to take into consideration that there will be a sales charge and standing order fee every time money is transferred. UTF also has the feature that allows unit holders to automatically reinvest the dividends that are paid out. These dividends will be converted into new units. The listed companies should consider introducing automatic reinvesting of dividends.

[e]. Cooling off period

When investing in a UTF, first time unit holders are given a 6 working day period to decide if they are satisfied with the UTF that they have invested in. If they are not satisfied with it, they can put in a request to withdraw their money at no charge.