CEF Vs UTF

INTRODUCTION

Common examples of collective investment schemes (CIS) would be unit trust funds and closed-end funds. The ordinary Malaysian investor should have plenty of experience with unit trust funds but few would be familiar with closed-end funds. This special series of i Capital will take a detailed look at both these investment vehicles and conclude on the attractions and weaknesses of both vehicles. It will start with the basics of a CIS and will become more detailed and complex as the series unfold. Do not miss this series as there are plenty to learn from it.

A CIS is a scheme where a group of investors with the same or similar investment objectives pool their money together and invest. Usually these investors do not have the skills, time, funds or resources to invest on their own. As such, they pool their funds and pass it to professionals to manage it for them.

There are many types of CIS. They are defined by their structure, investment objectives or composition of the fund or the investment destination. However, whether the CIS is a unit trust fund or a closed-end fund, there are certain characteristics of a CIS that appeal to investors. These would include professional management, portfolio diversification, economies of scale, greater investment exposure, ease of administration and small initial investment. These features are meant to help investors achieve returns that are higher than fixed deposit rates or perform better than the KLSE Composite Index. Unfortunately, if it is not managed properly, an investor could be worse off.

[a] Professional management

For investors who do not have sufficient funds to park with a fund management company, a CIS is one of the avenues for investors to tap the expertise of a professional fund manager, presumably such fund managers would have a good track record and backed up by a team of analysts conducting research and analysis of companies, industries and economies.

On top of tracking the performance of the funds, the fund manager would also be on a constant look out for attractive new investment opportunities. For an ordinary investor to find such investments may be more difficult, because these hidden gems might not be discovered by the mass media, which is the common source of information for investors, until much later. By the time it is covered by the mass media, everyone would flock to the stock and investors would have to chase the price. While managing the investments in a portfolio is a full time job for the fund manager, the investor can only spend a fraction of his time managing his portfolio. Even if the investor were to spend all his time managing his investments, he might lack the tools or skills or resources to make an informed decision.

Besides offering skills and experience, many fund management companies do not have an independent structure. These fund management companies are usually part of large financial groups. An independent structure is very important, because it prevents conflicts of interest. A financial group may have a stock broking arm, a unit trust management company (UTMC) and a merchant bank for example. In such groupings, there are many interests and sources of income to look after. Who should the fund manager be loyal to? For an independent fund manager that has only one source of income, the focus and loyalty to its clients is very clear.

Other than having an independent structure, a total commitment and integrity, the fund manager must have a sound investment framework. A sound investment framework with a clearly defined investment philosophy will guide them in their investment decision making process so that decisions based on a set of carefully thought out criteria and not emotions or rumours or tips or hearsay can be made. An important reason why many fund managers do not perform well is because they lack an intellectually sound investment framework.

All prospectuses will state the investment philosophy, but it is usually just two sentences long. The investment philosophy of the fund or the fund manager is so vague that an investor would not know what to make out of it. This is one of the most important things that an investor should know before investing in a CIS.

Investors always invest based on past performances, but as every prospectus states ‘past performance is not a guarantee for future performance’. The track record of a CIS would essentially belong to a specific fund manager. If the fund manager leaves, then the track record of the CIS or fund actually follows the fund manager. So before an investor invest in a CIS, they have to know whom does the track record belong to. For fund management companies that are owner operated, they offer the important advantage of consistency. As they are the owners, they do not have to worry about good fund managers leaving or the investment philosophy being changed.

As the CISs have similar features and structures, the main difference is human capital – specifically, the quality of the fund manager. The fund manager will be the deciding factor in determining whether the CIS or fund will perform with flying colours or be a total disaster.

[b] Diversification

There are all sorts of risks involved in investing. Some of the risks involved would be market risk, inflation risk, interest rate risk, company specific risk, credit risk, loan financing risk, liquidity risk, compliance risk, etc. While this whole list of risks might sound very formidable to an investor and it might seem like a wise decision to put your money in the bank, one of the greatest risks that a saver or investor faces is inflation risk. If the inflation rate is higher or rising faster than your income is, then, your real purchasing power would be reduced. On top of reducing your real purchasing power, you have also incurred an opportunity cost. Inflation risk is very scary because it is unnoticed and eats into your wealth and income in a very stealth-like manner.

Diversification is often touted as one of the methods to reduce the risk involved in investment. A supposed benefit of investing in a CIS is that the sum that you have invested, no matter how small the amount is, can be instantly diversified into different stocks and different industries, depending on the type of fund that you have invested in. By having a diversified portfolio, if some investments are not doing well, then it will not significantly affect the performance of the whole portfolio.

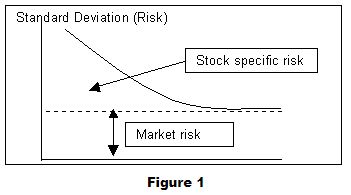

The conventional advice is you should not put all your eggs in one basket. But few people know what is the optimal level of diversification. How many stocks do you have to invest in before it is considered diversified? When does the additional stock that you add in stops making a difference? According to the Modern Portfolio Theory (which i Capital does not believe in), when you have about 20 stocks in your portfolio, you would be very close to optimal diversity – see Figure 1. The chart shows how diversification reduces stock specific risk. It shows that by increasing the number of stocks that you are holding after the 20th stock, the risk does not reduce all that much, it is more or less constant. Sometimes for the sake of diversification, fund managers tend to over diversify just for the sake of diversifying. In this case, diversification does not really work to the advantage of investors, because the fund manager might be investing in many mediocre performing counters, instead of investing in a few counters with superior performance. The counters that have only achieved mediocre performance will dilute the superior performance of the few selected counters.

Here one has to be careful. Risk according to modern finance theory is defined as the volatility of the stocks in relation to a market index. Risk to a value investor like i Capital means very different things. Risk to a value investor is when the share price is above its intrinsic value.

[c] Economies of scale

Due to the size of the CIS or fund, the fund management company can get a lower transaction rate from the stockbrokers. While the transaction costs might look very miniscule and investors might not notice it, little costs can add up to a big sum. Every time a fund manager buys and sells a counter it incurs costs that the investor has to pay. This cost will eat into the returns that the investor is going to get and can cancel out some of the benefits that economies of scale provide. In addition, to do the kind of research that a fund manager and his team of analysts would conduct would be costly for the ordinary investor. Whereas in a CIS, the research cost is spread out among the investors.

[d] Investment opportunities

CIS are allowed to invest a certain portion of their funds in overseas markets. If the CIS or fund has a skilled and experienced fund manager, an investor would be able to enjoy the benefits that the foreign stock markets can offer. As an ordinary investor, it would be very difficult to invest overseas, perhaps due to the lack of knowledge about the overseas markets, uneconomical to invest a small sum in an overseas market, etc. A CIS would also allow investors with a modest sum of money to have an overseas exposure.

[e] Ease of administration

Due to the diversification characteristic of many CISs, an investor only has to monitor the performance of that CIS instead of the many diverse investments. This can save time and administrative work for the investor. But this does not mean that once an investor has invested in a CIS, he does not have to look at the portfolio of his CIS.

[f] Small initial investment

The minimum amount that is needed to invest in a CIS is relatively small in comparison with opening a personal account with a professional fund manager or directly investing in a whole host of companies. For unit trust funds, you can invest on a regular basis from as low as RM100.00 a month or you can choose to invest a lump sum. In the case of a close-ended fund, you can buy one lot or 100 shares each time. With such a small sum of money, an investor can get all the benefits that are provided by a well managed CIS or fund.

Conclusion

While CISs are supposed to be safe investments that aim to provide investors with moderate sums of money a chance to earn superior returns, there are many, many pit falls involved that an investor should be aware of. Investing in a CIS, particularly the unit trust funds, is certainly not as simple as they look or sound. One of the most tricky issues is the performance measurement of unit trust funds. In addition, many of the pit falls are connected with the fund management company of fund manager. We hope that Malaysia would have more well-managed closed-end funds. As a CIS, closed-end funds offer many attractive features that unit trust funds just simply cannot offer.