Education

- ICAP’s Performance Evaluation

- CEF Vs UTF

- What are CEF Vs UTF?

- How CEF and UTF Work ?

- Regulatory Framework

- Marketing CEF vs UTF

- CEF Vs UTF Performance

- CEF Vs UTF Features

- Conclusion

- 2024-05-02 icapital.biz Berhad (ICAP) shares outperforms MSCI Malaysia, S&P500 and Nasdaq over one- and three-year period in US Dollar terms – en-US

- 2024-05-02 icapital.biz Berhad (ICAP) shares outperforms MSCI Malaysia, S&P500 and Nasdaq over one- and three-year period in US Dollar terms – ms-MY

- 2024-05-02 icapital.biz Berhad (ICAP) shares outperforms MSCI Malaysia, S&P500 and Nasdaq over one- and three-year period in US Dollar terms – zh-CN

How CEF and UTF Work?

How a Closed-End Fund works

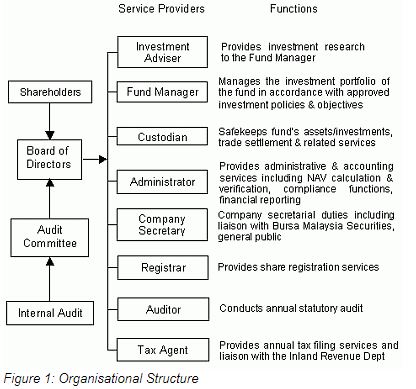

[a]. Organisational Structure

A closed-end fund (CEF) is commonly structured as a public limited company incorporated under the Companies Act and listed on the stock exchange. Different classes of shares can be issued to investors. Besides ordinary shares, a CEF may issue preference shares or attach warrants to the shares as ‘sweeteners’.

Figure 1 shows the typical structure of a CEF. The Board of Directors, although still carrying out its duties under the Act, does not take on an executive role. They undertake a more supervisory position in ensuring that the CEF is at all times operating in an orderly fashion. The various functions can be carried out within the group or outsourced. If outsourced, which is the typical case, the Board of Directors will appoint various independent service providers and ensure that everyone carry out their duties according to the terms and conditions agreed in the appointment. The independent nature of each service provider would ensure that there is a check and balance on the operations of the CEF. The Audit Commmittee and the Internal Auditor would further enhance good corporate governance.

[b]. Pricing of CEF Shares

Unlike unit trust funds (UTF), the share price of a CEF does not have to follow its net asset value. Like all shares trading on a stock exchange, the share price of a CEF is subject to the forces of demand and supply. The movements in a CEF?s share price is, nevertheless, influenced by the performance of the underlying investments and market sentiment. A CEF that trades above its NAV per share will be trading at a premium and a CEF that trades below, will be trading at a discount. In the later parts of this series, we will explain how this premium/discount feature can offer investors additional returns. Such a feature cannot be found among UTF.

[c]. Buying and Selling CEF Shares

The buying and selling of CEF shares are the same as buying and selling any shares that are listed on the stock exchange. The market prices are published daily in the major newspapers. During the IPO stage, investors will need to subscribe to the shares either through a private placement, restricted offer to targeted investors or public offer. After the IPO, investors may buy them in the secondary market by calling their brokers or remisiers. If an investor buys during an IPO, there is no service charge incurred except for some out-of-pocket expenses for lodging the IPO application. Investors who buy or sell in the secondary market via the brokers or remisiers will need to pay the usual brokerage commission. The brokerage fee amounts to about 0.6% or even less if the volume of trade is substantial. This is cheap in contrast to the loading fees of between 2% to 7% that a UTF investor needs to pay when buying or selling their units in the UTF. The minimum investment for a CEF is 100 shares which is very affordable.

How A Unit Trust Works

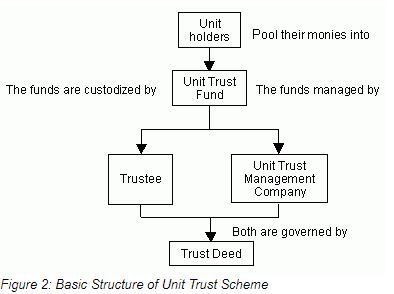

[a]. Structure

The players in a unit trust scheme are the unit holders, the unit trust management company (UTMC) and the Trustee. The unit holders provide the funds for the unit trust funds (UTF), which are then managed by the UTMC. To protect unit holders, the UTMC is not allowed to hold the assets of the fund in its own name. This is where the Trustee comes in. The Trustee is appointed by the UTMC and the appointment must be approved by the Securities Commission (SC). The relationship between the unit holders, UTMC and Trustee is governed by a document known as the Trust Deed. The Deed is effectively the constitution of the UT scheme, just like the Articles of Association is the constitution of a company. It is prepared by the UTMC and registered with the SC. The Deed essentially spells out the terms and conditions governing the day-to-day operations and management of the UT scheme, rights and liabilities of the unit holders and duties and obligations of the UTMC and the Trustee.

[b]. Pricing of UTF

The pricing of UTF is much more convoluted than that of a CEF.

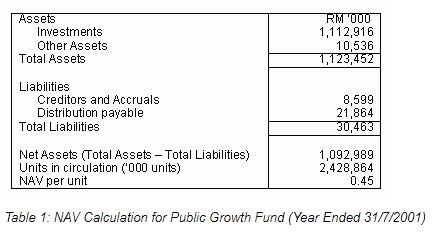

[i]. Net asset value (NAV)

In simple terms, NAV is simply the net worth of the UTF, which is what the fund is left with after paying off all its liabilities. The formula for NAV per unit is as presented below. Table 1 below shows the example of the NAV calculation for Public Growth Fund.

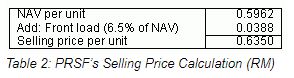

[ii]. Selling price and front load

Most investors are confused between the ‘selling’ and ‘buying’ price of a UTF. The selling price is the price where unit holders buy from the UTF (or the UTF selling to unit holders, thus selling price). For equities-related UTF in Malaysia, the selling price is derived by adding a front load of between 2% to 7% on top of the NAV. This is known as front loading. The front load are expenses comprising commissions paid to parties who help to sell the UTF such as financial planners, banks, insurance companies, etc. For example, the NAV per unit of Public Regular Savings Fund (PRSF) on 31 Dec 2001 is RM0.5962. With a front load of 6.5%, the selling price of a unit of PRSF would be RM0.6350, as shown in table 2 below :

Say, investor A decided to invest RM1,000 into PRSF on the same date. At RM0.6350, he would have received 1,574.80 units in PRSF. The calculation is shown below.

= Amount invested/Selling price of the day

= RM1,000/RM0.6350 (NAV + front load)

= 1,574.80 units

When talking about an industry that has a load of up to 5% and above, the only comfort is that we are not alone in this world. Even the unit trust or mutual fund industry in the US, which has the largest unit trust companies, surprisingly still has UTF with loading that is equivalent to what is charged here. The fact is that there is a lot of room for the loads to go down. Or even better there should be no loads in the first place. Vanguard, the world?s second largest unit trust company after Fidelity, has been doing that since its inception. Taking an average front load of 5% and the total local unit trust NAV of RM88 bln, we are talking about RM4.4 bln going to loadings. Wow!!

[iii]. Buying price and back load

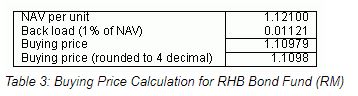

As for buying price, it is the price the UTMC pays to buy the units back from the unit holders. Some funds impose a charge when buying back the units, known as back loading. Fixed income funds are the usual funds that impose such charges if investors withdraw their money within a short period, usually within 1 year. The argument presented by the UTMCs for such a charge is that they are encouraging unit holders to hold the UTF for the long term. Table 3 below is an illustration of a back load charged on the RHB Bond Fund. The fund charges a back load of 1% on unit holders who withdraw their money within 1 year.

[iv]. Historic pricing and forward pricing

There are 2 types of method to price the selling and buying price for UT, namely, historic pricing and forward pricing.

Under the historic pricing method, the NAV used to price the selling and buying price of a UTF is based on the immediate NAV of the fund at the close of Bursa Securities before the request to buy/sell units is received by the UTMC. For instance, the NAV of a UTF calculated at the close of Bursa Securities on Wednesday will be the NAV used for any buying/selling of units for that fund on Thursday, until the next valuation is computed at 5 pm on Thursday. So, with historic pricing, an investor would have known the NAV of the fund that he is buying/selling before actually executing his buy/sell decision.

As for forward pricing method, the NAV used to price the selling and buying price of a UTF is based on the immediate NAV of the fund valued at the close of Bursa Securities after the request to buy/sell units is received by the UTMC. This means that if an investor were to buy/sell units in a UTF on Thursday at any time before 5 pm, the NAV used to calculate the buying/selling price is based on the NAV calculated at the close of Bursa Securities on Thursday. Therefore, with forward pricing, an investor would never know the NAV used for the execution of its buy/sell request until the market closes on that particular day.

[c]. How to buy and sell

The buying and selling of UT is done via agents or through a bank instead of brokers or remisiers. Buying and selling UT is not as straightforward as just a phone call away. Whenever investors are buying and selling units of a UTF, they will need to fill in form/s. If an investor is buying into a fund for the first time, he will have to fill an account opening form and a subscription form, and provide a photocopy of his identity card. Subsequently, if he intends to buy additional units of the same fund, he needs only to fill in the subscription form. For selling the units, he needs to fill in a redemption form. He will receive his monies in the form of cheques within 10 working days. The buying of additional units or selling of existing units need not be done in the same branch where the investor first started his account. It can be done in any other branches of the same bank, unless the branch does not cater for any UT investment services. To save the form-filling hassle, investors can also give standing orders to any of their banks to buy units of a particular UTF on a regular monthly interval.

Investors can also use their Employees’ Provident Fund (EPF) to buy into UTF. However, this is only for investors who have at least RM55,000 in his EPF Account 1 and have not reached the age of 55 years old. For these investors, they are allowed to invest up to 20% of the amount exceeding RM50,000 in their Account 1, subject to a minimum investment of RM1,000. For example, if an investor has RM58,000 in his Account 1, he can invest a maximum of RM1,600 ([RM58,000 – RM50,000] X 20%) in any UTF. However, any return from the UT investment or monies received from disposal of the units will be credited back into the Account 1. In the case of purchasing UT through EPF, investors have to provide an ‘EPF Statement Slip’ obtained from the EPF, photocopy of their identity card, fill in the UT subscription forms as well as the KWSP 9F (AHL) obtained from the EPF.