An Evaluation of ICAP’s Performance and Determinants of its Discount

Presented by Dr Lorenzo Casavecchia, Finance Department, UTS Business School

Date: 4th & 5th November 2023

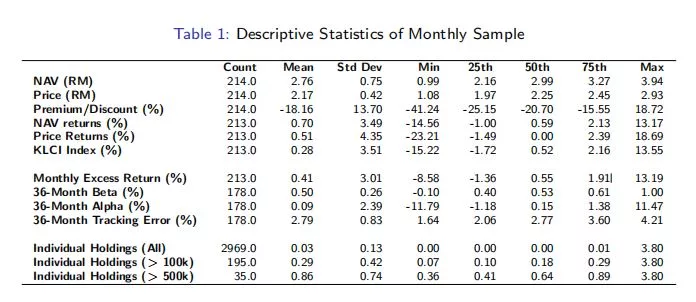

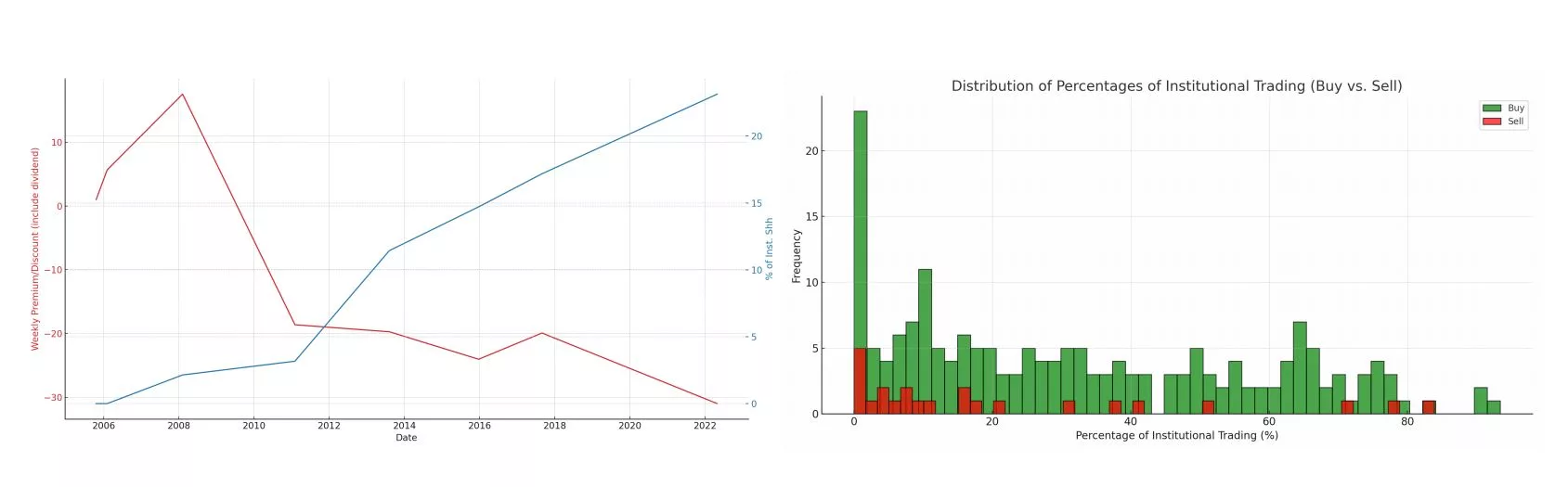

ICAP — Descriptive Statistics

|

ICAP — NAV Return, Price Return and Premium/Discount

|

Academic Explanations for CEF Discounts

|

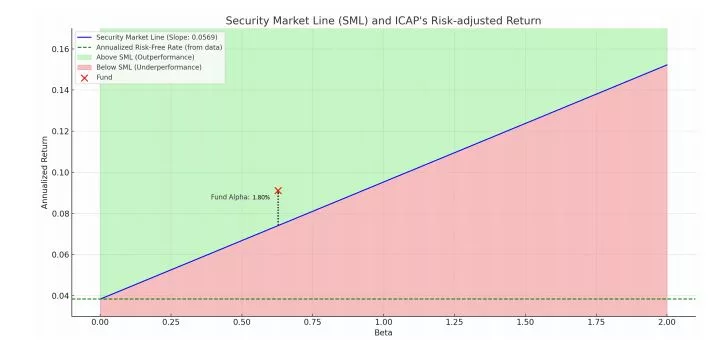

ICAP’s Risk-adjusted Performance vs. KLCI Index

|

ICAP’s Alpha (α) vs. KLCI

|

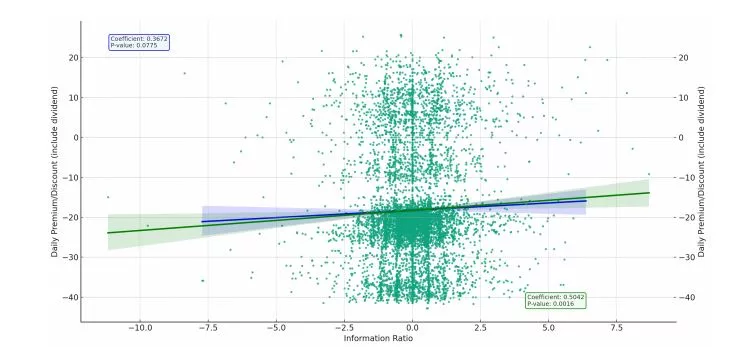

Could ICAP’s performance Explain the Discount?

|

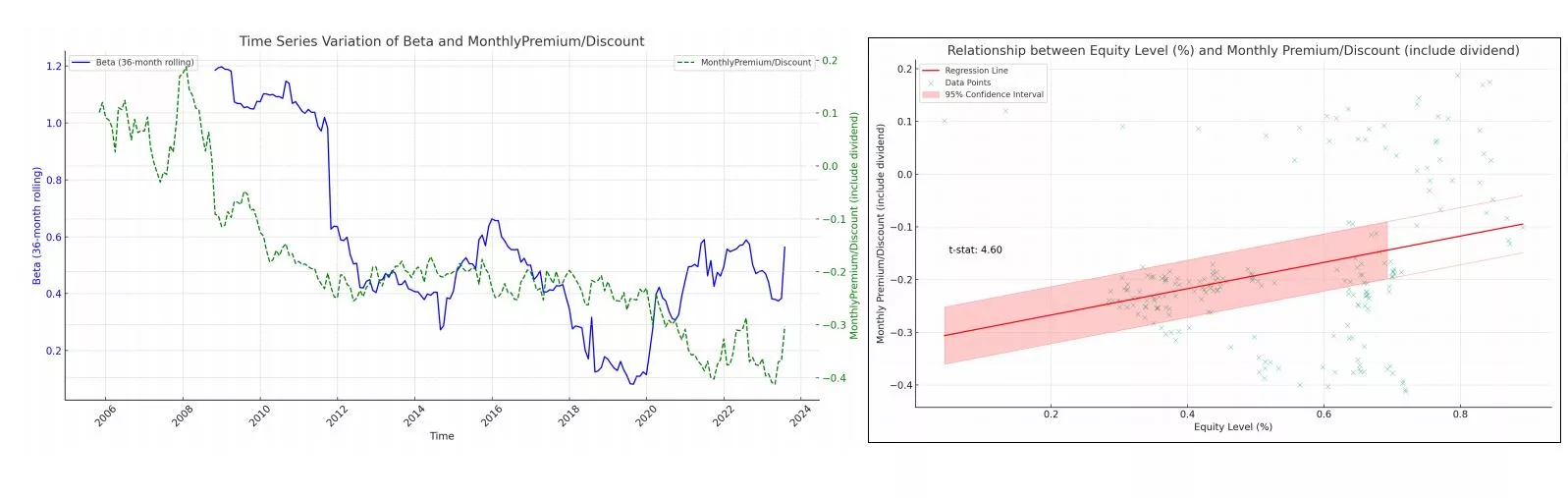

Could ICAP’s Asset Allocation Explain the Discount?

|

Could Large Institutional Holdings Explain the Discount?

|

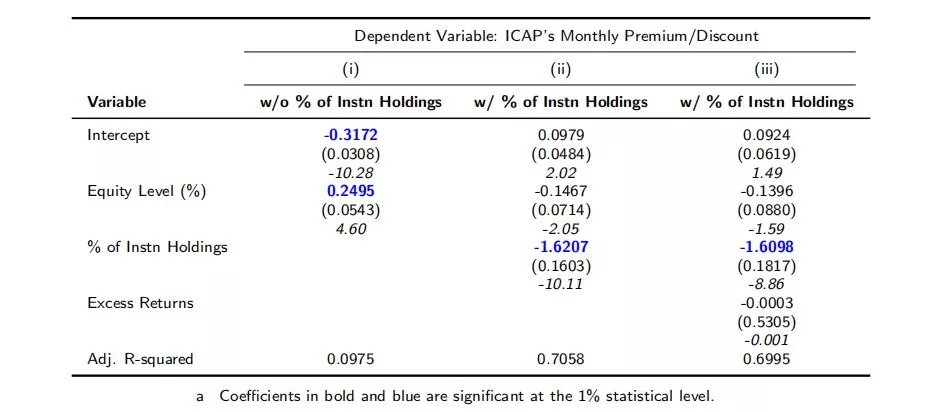

ICAP Discount — A ”Horse Race” of Factors - And the Winner is...

|

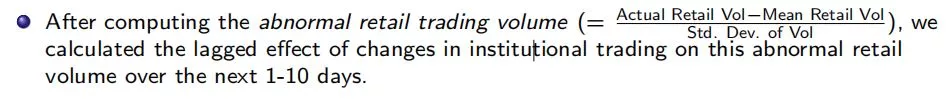

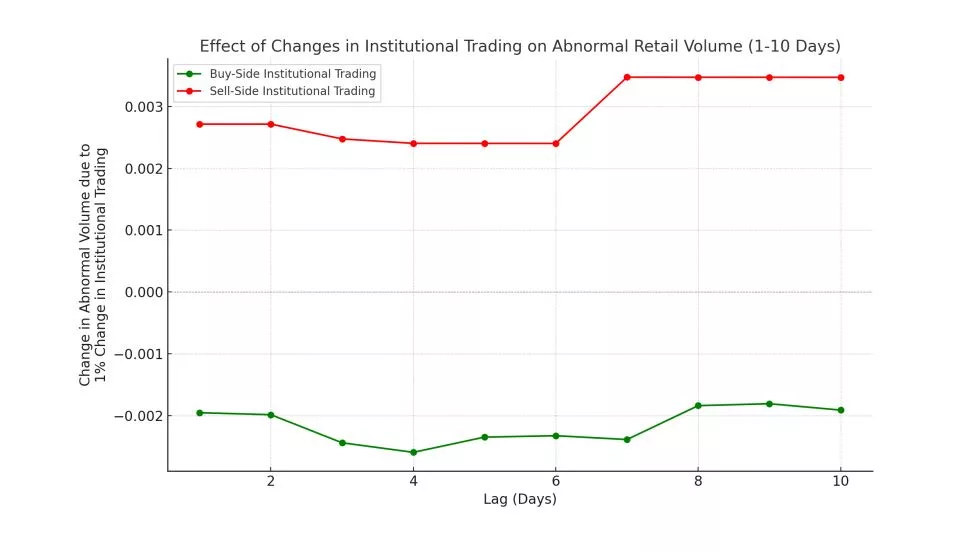

Institutional Trading, Adverse Selection and Secondary Market (Il-)liquidity

Interpretation:

|

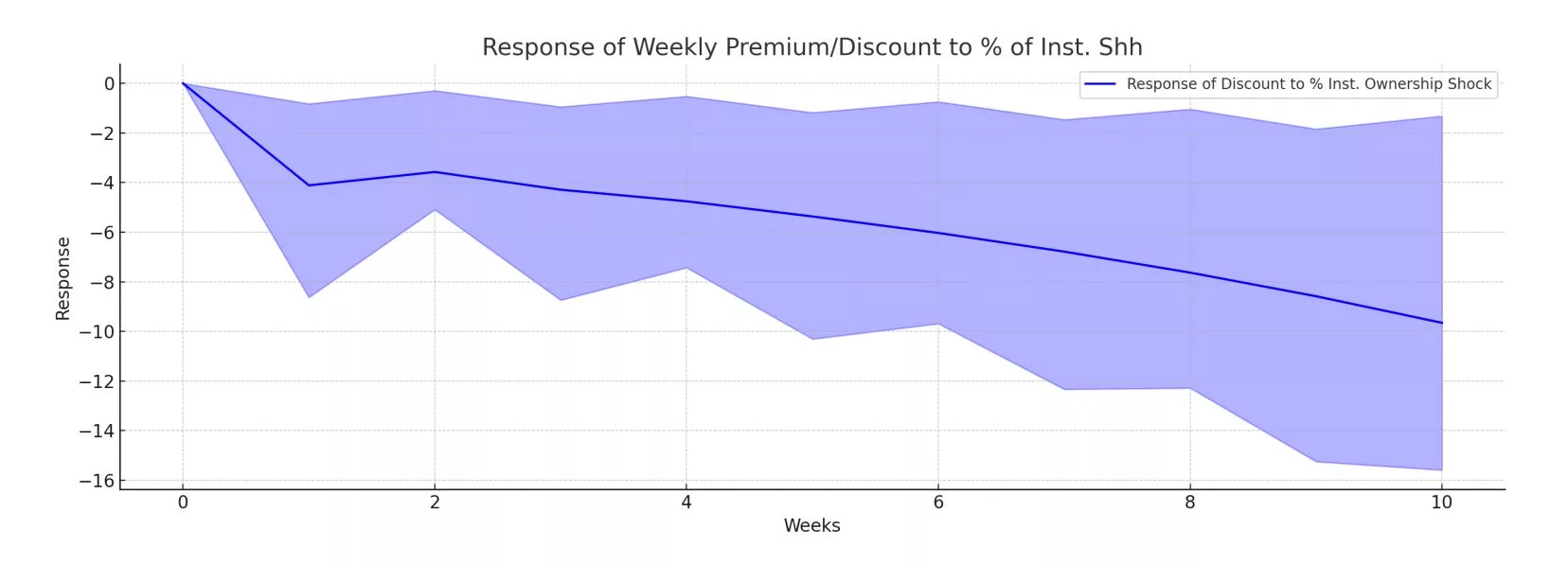

Granger Causality test — Discount vs. Instn ownership

Interpretation: The 1-week response (lag 1) of the ”Weekly Premium/Discount” to a shock in “% of Inst. Shh” is approximately 4.11— a one-percentage shock (increase) in the “% of Inst. Shh” leads to a 4.11% increase in fund’s discount during the following week. |

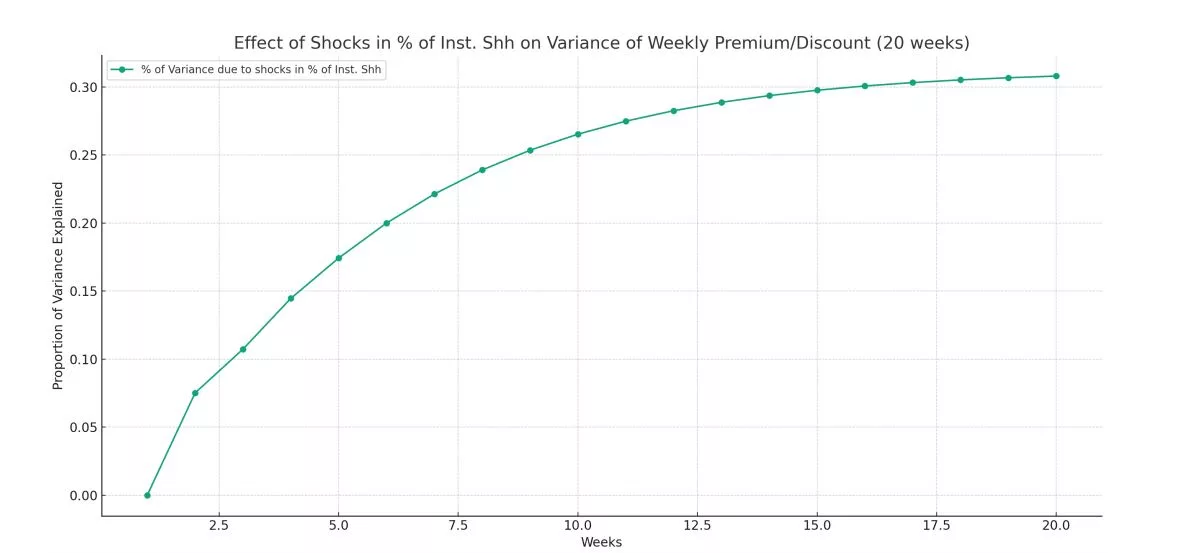

Forecast Error Variance Decomposition (FEVD) of ICAP’s Discount

|

Concluding Remarks

|

Disclaimer

- This presentation is strictly for informational and educational purposes and should not be construed as legal, financial, or investment advice. It is presented without any guarantee, representation, or warranty regarding its accuracy, completeness, or suitability for any particular purpose. These views do not represent or imply the endorsement or agreement of any specific institutional investor or entity

- The content herein is not intended to defame, disparage, or cast aspersions on any organization, company, or individual. All statements and opinions are made in good faith, based upon rigorous academic research and analysis. This presentation does not constitute an offer or solicitation for the purchase or sale of any financial instrument, nor should it be considered as an official confirmation of any transaction.

- The information provided is subject to change at any time without notice, and there is no commitment to update the presentation in the event of new information or future events. Reproduction, distribution, or publication of this document is strictly prohibited without express prior written consent from the author(s).

- The responsibility for any decisions, interpretations, or actions based on this presentation lies solely with the individual attending the presentation or accessing this document. By participating in or accessing this presentation, you acknowledge and agree to the limitations and terms set forth in this disclaimer and assume full responsibility for your use of the information provided.